Every purchase, abandoned cart, and glowing review is a window into what drives your audience. Critical insights are lost in the noise without a structured way to compile this information.

When well designed, customer feedback surveys become your direct hotline to the customer’s voice, highlighting points where customers show a need for clarity, frustrations, and moments of delight.

Badly designed surveys can result in low response rates, survey fatigue, and skewed responses, giving a false sense about their e-store customers.

In this guide, we’ll walk you through the essential steps in creating a customer feedback survey that will help optimize the response rate and quality of data.

Building the Perfect Question Flow

The sequence and type of questions can make or break the survey experience.

A well-structured flow ensures respondents stay engaged, avoid frustration, and provide valuable insights.

When a survey feels intuitive and comes easily, it encourages participants to complete it and answer honestly.

1. Start with an Easy Win

The opening of your survey is very important. Starting off with an easy, direct question not only warms up your respondents but also builds confidence and engagement.

Examples:

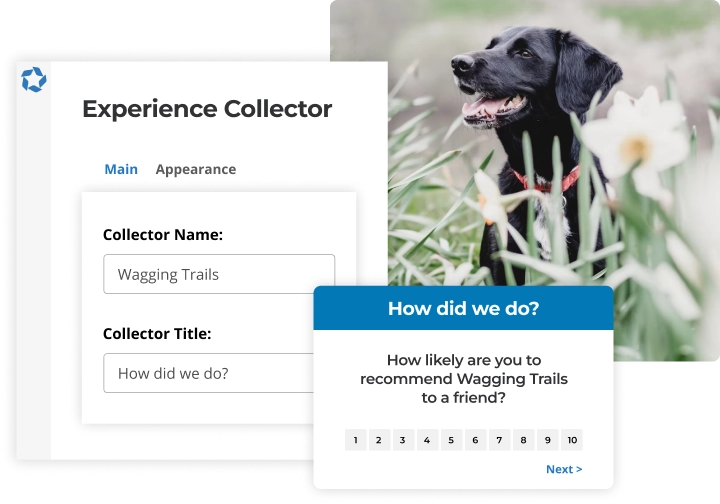

- “How likely are you to recommend our store to a friend?” (Net Promoter Score, or NPS)

- “On a scale of, how would you rate your overall satisfaction with the recent purchase?”

2. Group Related Questions Together

Jumping between unrelated topics can confuse and frustrate respondents, causing cognitive overload. Grouping similar questions in clear sections ensures a smoother experience and keeps participants focused.

Example Groupings:

- Product Feedback: Questions relating to product quality, features, or packaging satisfaction.

- “How satisfied are you with the quality of the product you purchased?”

- “Were the product features as described on our website?”

- Customer Service: Questions about customer service experience or interaction.

- “To what extent would you rate our customer support team as helpful?”

- “Did our team resolve your issue in a timely manner?”

3. Save Open-Ended Questions for the Last

Open-ended questions can be an incredibly effective way to gain deeper qualitative insights; however, they require a lot more work from respondents and are, therefore, potentially burdensome to introduce too early.

Examples:

- “What could we do to make your next shopping experience even better?”

- “What do you think is the single most important thing we could do to better our service?”

Optimizing Rating Scales

Rating scales are one of the most effective tools in online surveys for quantifying customer sentiment and satisfaction levels. They provide structured, easy-to-analyze data to inform business decisions and track trends. However, the effectiveness of scale questions hinges on their design.

Poorly constructed scales can confuse respondents, distort results, and produce inaccurate or unusable data. A thoughtful approach to rating scales ensures that your survey responses are reliable and actionable.

Here’s how to optimize your rating scales to improve the quality of feedback while ensuring a seamless survey experience.

1. Use Consistent Scales Throughout Your Survey

The continuity in the format in which you have set the scale provides clarity and avoids survey fatigue among the participants.

Jumping back and forth between question types, having some use the 1–5 and others the 1–10 scale, for instance, may confuse your respondents about what scale has been referred to.

The uniformity within your scaling improves data quality and allows the comparison across questions and surveys a lot better.

Example:

- Consistent Scale:

- “How would you rate your shopping experience? (1–5)”

- “How likely are you to recommend us? (1–5)”

- Inconsistent Scale:

- “How would you rate your shopping experience? (1–5)”

- “How likely are you to recommend us? (1–10)”

2. Clearly Define the Endpoints

A rating scale is only useful if respondents understand what each point represents. Without clear definitions, the scale becomes subjective and open to interpretation, reducing your data’s reliability.

Defining the endpoints ensures that respondents interpret the scale in the same way.

Best Practices:

- Label endpoints with descriptive phrases, such as:

- 1 = “Very Dissatisfied”

- 5 = “Very Satisfied”

- If using a broader scale, add descriptors for middle and high points:

- 1 = “Extremely Poor”

- 3 = “Neutral”

- 5 = “Excellent”

3. Offer a Neutral Option

Not all respondents will have a strong opinion about every question. Forcing them to choose between extremes can lead to inaccurate or skewed responses.

Including a neutral midpoint provides an option for those who genuinely feel indifferent, ensuring more accurate data.

Example:

- Question: “How satisfied are you with our customer support interactions?”

- 1 = Very Dissatisfied

- 2 = Dissatisfied

- 3 = Neutral

- 4 = Satisfied

- 5 = Very Satisfied

4. Avoid Overly Long Scales

While a 10-point scale may offer more granular data, it can overwhelm respondents and lead to inconsistent use.

Many people struggle to differentiate between close values (e.g., 6 vs. 7), making a 5-point scale a more user-friendly option in most cases.

When to Use Shorter vs. Longer Scales:

- 5-Point Scales: Ideal for most customer satisfaction surveys, as they balance detail with simplicity.

- Example: “How likely are you to purchase from us again?”

- 1 = Not Likely

- 5 = Very Likely

- Example: “How likely are you to purchase from us again?”

- 10-Point Scales: These are best for questions requiring more detailed sentiment analysis, such as Net Promoter Score (NPS).

- Example: “How likely are you to recommend our store to a friend?”

- 1 = Not Likely at All

- 10 = Extremely Likely

- Example: “How likely are you to recommend our store to a friend?”

Mobile-Friendly Design: Best Practices

1. Minimize Text

Mobile users often complete surveys on the go, where attention spans are short, and distractions are plentiful.

Lengthy, wordy questions can overwhelm respondents and increase dropout rates. Keeping text concise ensures that your survey feels quick and easy to complete.

How to Apply:

- Example Before Optimization:

- “Please describe your experience shopping on our website, including details about navigation, product pages, and checkout process.”

- Example After Optimization:

- “How would you rate your shopping experience on our website?”

- Break complex questions into smaller, simpler ones:

- Instead of: “Rate our customer service, product quality, and delivery on a scale of 1-5.”

- Use: “How would you rate our customer service?” (Followed by separate questions on product quality and delivery.)

2. Use Touch-Friendly Elements

Navigating a survey on a mobile device should feel effortless. Small buttons, hard-to-tap checkboxes, and poorly designed sliders can frustrate respondents, leading to errors or early exits.

Touch-friendly design ensures that your survey is accessible to all users, regardless of their device or dexterity.

How to Apply:

- Button Design: Use large, well-spaced buttons for single-choice questions. Avoid cramming multiple options too close together.

- Example: Instead of listing multiple choice options in a narrow vertical format, use wide, tap-friendly buttons like:

- [Very Dissatisfied]

- [Neutral]

- [Very Satisfied]

- Example: Instead of listing multiple choice options in a narrow vertical format, use wide, tap-friendly buttons like:

- Sliders and Scales: Optimize sliders for precision. Ensure the touchpoints are large enough to grab easily and the scale doesn’t require excessive scrolling.

- Bad Example: A slider with small touchpoints that make it hard to select the desired value.

- Good Example: A slider with large, visible markers for each scale point.

- Checkboxes: Use checkboxes sparingly and ensure they are spaced adequately.

3. Preview on Multiple Devices

No two mobile devices are exactly the same. What looks perfect on a modern smartphone with a large screen might be cramped or misaligned on an older or smaller tablet.

How to Apply:

- Test your survey on various screen sizes, from small smartphones to large tablets.

- Ensure no text or buttons are cut off due to narrow screens.

- Check that interactive elements like sliders and drop-down menus function correctly across devices.

- Verify that images (if used) are responsive and don’t cause formatting issues.

Pro Tip: Simulate low-bandwidth environments to ensure your survey performs well for users with slower internet speeds.

4. Simplify Navigation

Scrolling and navigating between screens on mobile devices can be cumbersome if the survey design isn’t intuitive. Ensure your survey is easy to navigate with clear instructions and user-friendly transitions.

How to Apply:

- Use a single-question-per-screen format where respondents can focus on one item at a time.

- Include a progress bar to show how far respondents have come and how much is left, reducing drop-offs.

- Avoid unnecessary back-and-forth navigation by grouping related questions logically on the same screen.

5. Use Mobile-Specific Features

Designing for mobile allows you to leverage features unique to mobile devices, making the survey experience more interactive and engaging.

How to Apply:

- Tap and Swipe Interactions: Replace traditional click-based navigation with gestures familiar to mobile users.

- Example: Swipe left to answer “No,” swipe right to answer “Yes.”

- Voice Input: Allow respondents to dictate open-ended responses if their device supports voice-to-text.

- Camera Integration: For product feedback, consider adding an option for respondents to upload photos directly from their device.

Incentive Strategies That Drive Participation

Incentives can really help increase response rates in customer surveys, but they must be designed carefully to avoid bias in the data.

1. Offer Meaningful Rewards

A good incentive should resonate with your customer base and truly deliver some value.

Generic or irrelevant rewards hardly incite people to take action, whereas personalized incentives tend to engage participants more.

Choose rewards aligned with your business goals and customer preferences; this way, participation feels worthwhile.

Examples of Effective Incentives

- Future Purchase Discounts: Motivate the customer with an incentive of a percentage or dollar discount on the next purchase. For example, “Take this survey and receive 15% off your next order.”

- Gift Cards: Universal or store-specific monetary rewards. Example: “Survey respondents will be entered into a drawing to win a $50 gift card.”

- Special Privileges: For repeat or VIP customers, offer access to new products, early-bird promotions, or free upgrades.

2. Avoid the Overpowering of Incentives

While generous incentives may raise participation rates, rewards that are too large may lessen the quality of your feedback.

If the reward is too high and too exciting, respondents may cut corners in the survey as fast as possible to get their prize, thus providing false information or incomplete responses.

How to Avoid Overpowering the Incentive:

- Scale Rewards Based on Survey Complexity:

- Quick 1–2 Minute Survey: Offer a slight discount or entry into a drawing.

- Longer, More In-Depth Survey: Offer a higher-value gift card or reward.

- Focus on Non-Monetary Incentives: Recognition, such as highlighting respondents’ feedback in your blog or social media, is a highly effective alternative.

3. Be Transparent

Transparency is the ultimate enabler of trust and eventual participation. Customers are more interested in taking a survey when they understand what to expect from the reward and where it will be delivered.

Unclear or obscured terms create frustration and damage the credibility of your brand.

How to Be Transparent:

- Reward Upfront: Clearly state the reward on the survey invitation or landing page. For example, “Take this quick 5-minute survey and get 20% off your next purchase!”

- Spell out Terms: Clearly explain how and when incentives will be delivered. For example, “Discount codes will be emailed within 24 hours of survey completion.”

- Avoid Overpromising: Ensure that the reward matches what is delivered. For giveaways, clearly indicate the odds of winning.

Benchmarking Response Rates

To evaluate the success of your survey, compare your survey response rates against industry benchmarks:

- Post-Purchase Surveys: around 30%

- Customer Satisfaction Surveys: 33%

- Survey Pop-Ups: 7%-30%

Low response rates may indicate survey design, timing, or distribution channel issues.

Quick Fix: Distribute email surveys or pop-up surveys at key touchpoints (e.g., after a purchase or delivery)

Key Principles for Effective Survey Design

It’s both an art and a science to create a great survey. It takes a thoughtful approach, attention to detail, and a focus on what matters to your audience.

Here are guiding principles so that your survey yields good responses and actionable insights into your customer’s journey:

- Focus on Precision and Simplicity. Unclear or overcomplicated questions might mislead respondents, resulting in incorrect or incomplete responses. Use straightforward, clear language, avoiding any technical terms or jargon that might alienate your audience.

- Keep Surveys Short and Intentional. Realistically, survey fatigue is real; the longer your survey is, the higher the chance that respondents will quit before finishing. To increase completion rates, only collect the necessary information and limit the number of questions whenever possible.

- Avoid Leading or Biased Questions. Your survey should leave room for honest feedback rather than leading the respondents towards a particular answer. Framing questions in an unbalanced or overly positive way biases your data and degrades its value.

- Include Screening Questions If Necessary. If your audience falls into a specific group you want to target, screening questions ensure the proper respondents take your survey. This is particularly valuable in surveys dealing with understanding product features or demographic studies.

- Offer a Balanced Mix of Question Types. Varying the format of your questions keeps respondents interested and opens up avenues for collecting varied information. Combine the convenience of data analysis made easy through closed-ended questions with deep-insight, open-ended questions.

Make Customer Feedback Your Competitive Edge

A well-designed customer feedback survey drives exceptional customer experiences and informed decisions.

By focusing on effective survey design, optimizing your survey format, and thoughtfully addressing customer satisfaction survey questions, you can collect meaningful insights and more positive responses that can boost satisfaction levels and grow your business.Check out RaveCapture to create impactful surveys that capture valuable insights and improve your survey responses. Take the first step toward building stronger customer relationships and achieving your business goals.